Casualty insurance is a type of insurance that covers you if you're lawfully responsible for another person's injuries or residential or commercial property damage, such as from a cars and truck mishap or an accident in your house. Below, we take a thorough take a look at what casualty insurance is, how it works, who submits the claim, and whether it deserves getting or increasing your protection. Casualty insurance coverage secures you when you're accountable for someone getting hurt or their possessions getting damaged. The situations in which you're covered depend on the specifics of your policy. For instance, an automobile insurance coverage might pay to repair a neighbor's fence after you drove into it.

Casualty insurance coverage doesn't cover your own injuries or home damage, or those of other people listed in your policy. If you own a business, business casualty insurance can secure you when a customer is hurt by among your service or products. Casualty insurance is usually bundled into your insurance policy, so you pay for it when your insurance costs is due. Your policy and quotes might specify just how much you pay for each protection, making it easier to change limitations to fit your budget and requirements. When taking a look at your policy, you'll generally find casualty insurance under coverages for others when you're at fault.

There are lots of scenarios where your casualty insurance would kick in to cover expenses. For example, house insurance may pay for expenditures and legal costs connected with:: A guest trips on their feet while in your house and breaks a wrist.: Your pet dog breaks complimentary throughout your early morning walk and bites another dog.: A windy day causes a branch from a tree on your property to break and put a hole in the next-door neighbor's roof. Automobile casualty insurance coverage can enter into play in a number of scenarios, such as when someone in another car is harmed in an accident you caused or if you accidentally hit a neighbor's mail box while making a U-turn.

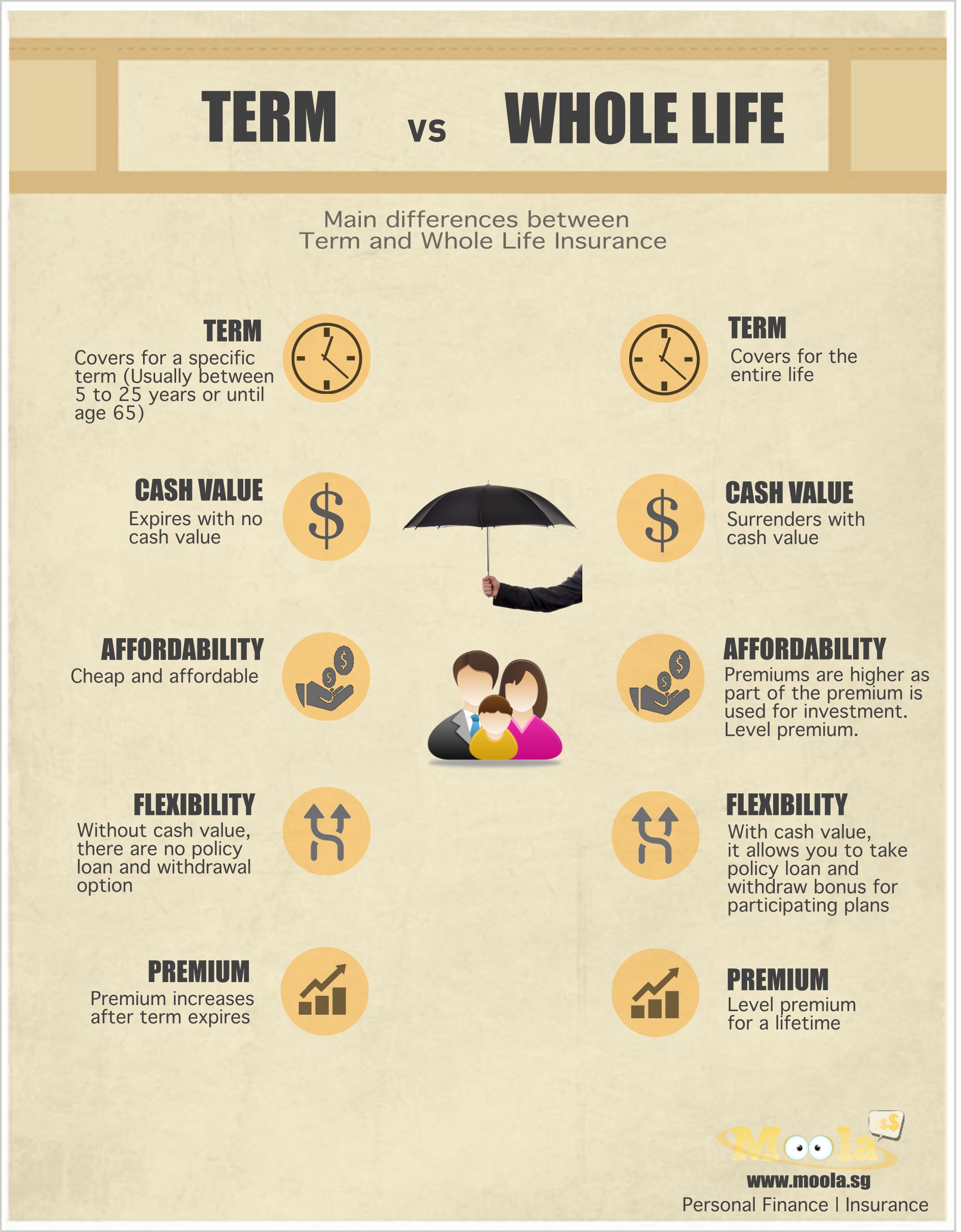

In basic, the other party submits the claim with your insurance if you're at fault for the damage or injury. What is term life insurance. House and car liability claims don't normally have a deductible, so your insurance coverage covers all expenses for authorized claims approximately your limits. If you're the one who was harmed or had property damage, you'll more than likely deal with the other person's claim representative or insurance coverage adjuster. Their insurance provider might pay your claim straight to you or another entity, such as a crash service center. Car insurer utilize cops reports, photos, information collected from you and the policyholder, and more to determine who is at fault and whether a liability payment is due.

If the concern is with a property owner and they have no-fault medical protection, you might be able to send costs straight to their insurance coverage company without needing to submit a claim initially. What is an insurance premium. After a car accident, it's necessary to call your insurance company, no matter who was at fault. Your insurance provider can then deal with your behalf to help you file a liability claim with the other insurance company. Liability limits are the maximum an insurer will spend for a claim. Requirement property owners policies typically offer $300,000 of personal liability for property damages and injuries and $1,000 to $5,000 for medical payments to others.

If timeshare for rent not, think about raising your coverage to the highest level you can reasonably manage. It is necessary to comprehend the distinction in between liability coverage and medical payments to others. Liability looks after medical costs if you're considered accountable for somebody else's injury. Medical payments is a more limited kind of coverage that pays no matter fault (and only to guests you welcome on your home, when it comes to a house owners policy). Vehicle insurance minimum liability limits are set by each sell a timeshare state, though these amounts might not be adequate to cover costs in a severe accident. Like with house owners insurance coverage, think about buying as much liability coverage as you can manage.

Expenses depend upon elements like your existing liability protection and your risk profile. In basic, a $1 million umbrella policy costs $150 to $300 per year - What is whole life insurance. Normally, the only casualty insurance coverage you're lawfully required to carry is physical injury liability and property damage liability under your car insurance coverage. Numerous states also need injury defense, and amounts differ by state. There are no state-mandated liability requirements for house insurance coverage policies, but standard house insurance coverage policies usually come with some protection and your mortgage loan provider will have its own requirements. Regardless of whether the law requires it, having appropriate casualty insurance economically shields you from paying out of pocket to cover costly legal fees, lawsuits, others' medical costs, and lost incomes.

How Much Do Prescription Drugs Cost Without Insurance? for Beginners

Casualty insurance coverage spends for another individual's injuries and home damage when you're discovered lawfully liable. Insurers just pay up to your liability limits, so you're accountable for expenses beyond those amounts. Umbrella insurance coverage can help select up the tab for excess amounts. It's last minute timeshare rentals bought as a separate policy. You're only needed to carry your state's minimum liability limitations on your car policy, but think about getting as much home and vehicle casualty insurance as you can fairly afford for higher monetary defense.

Casualty insurance coverage is a problematically specified term which broadly includes insurance not directly interested in life insurance, medical insurance, or residential or commercial property insurance. Casualty insurance coverage is mainly liability coverage of a specific or company for irresponsible acts or omissions. However, the term has likewise been utilized for residential or commercial property insurance, [] air travel insurance coverage, boiler and machinery insurance, and glass [] and criminal activity insurance coverage. It may consist of marine insurance coverage for shipwrecks or losses at sea, fidelity and surety insurance coverage, earthquake insurance coverage, political danger insurance, terrorism insurance, fidelity and surety bonds. Among the most common kinds of casualty insurance coverage today is auto insurance coverage. In its the majority of standard kind, auto insurance coverage offers liability coverage on the occasion that a chauffeur is found "at fault" in a mishap.

If protection were reached cover damage to one's own automobile, or versus theft, the policy would no longer be solely a casualty insurance coverage. The state of Illinois includes automobile, liability, worker's compensation, glass, livestock, legal expenses, and various insurance under its class of casualty insurance coverage. In 1956, in the beginning to the 4th edition of Casualty Insurance coverage Clarence A. Kulp wrote: Broadly speaking, it might be defined as a list of specific insurance coverages, typically composed in a separate policy, in three broad classifications: third party or liability, disability or accident, and health, product damage. Among the outcomes of thorough policy-writing ... some insurance men forecast that the casualty insurance coverage of the future will include liability and impairment lines just. Later on in Chapter 2 the book mentions that insurance was generally classified under life, fire-marine, and casualty. Since multiple-line policies started to be composed (insurance contracts covering a number of kinds of threats), the last two started to merge. When the NAIC authorized several underwriting in 1946, casualty insurance was defined as a blanket term for the legal liability other than for marine, disability and healthcare, and some damage to physical home.